In-depth evaluation: the country compensates for the steep slope and accelerates the reshuffle of new energy.

[car home’s deep comment] On March 26th, the anniversary of Ding Maoyue’s death, it was appropriate to set up a coupon and open the market. At about 18 o’clock in the afternoon, when most of the autobots got off work, a notice was posted on the website of the Ministry of Finance-Notice on Further Improving the Financial Subsidy Policy for the Promotion and Application of New Energy Vehicles (hereinafter referred to as the Notice or Caijian [2019] No.138). The Ministry of Finance, the Ministry of Industry and Information Technology, the Ministry of Science and Technology and the National Development and Reform Commission "set up a voucher" together, and set a contract between the central government and automobile manufacturers and consumers of new energy vehicles on the subsidy policy for the promotion and application of new energy vehicles in China in 2019, which also means that the new energy vehicle market in 2019 can finally be opened.

"It’s finally out." The author contacted several colleagues in the industry, and the attitude towards this notice was surprisingly consistent. After months of waiting, the industry is more concerned about when the policy will be implemented, rather than the level of subsidies.

● What is "Deep Comment"?

《Asked deeply.""is the first program created in car home for users in the industry, written by senior practitioners in the automobile industry, to exclusively analyze/reveal major events in the industry. In addition to the lively appearance, we want to show you the exploration and thinking of the essence, cause and effect and future possibility of things.

Current industry commentator-Khufu, an atypical autobot working in an automobile company. Over the past ten years, I have traveled around Industry-University-Research, a city related to the automobile industry, and I have my own understanding and thinking about the industry, learning from each other through the platform of "car home".

Read the full text in 30 seconds:

● In 2019, the state subsidy was less than the legend, and the threshold for obtaining subsidies was higher; Local subsidies are directly suspended.

● This time, the government’s expectation management has been done very well. What the industry practitioners are most concerned about is not the amount of subsidies, but when the policies will be released.

● For the industry, a sharp decline in subsidies is a powerful medicine to screen out strong multinational companies that are about to enter in a big way.

First, the late subsidy policy in 2019

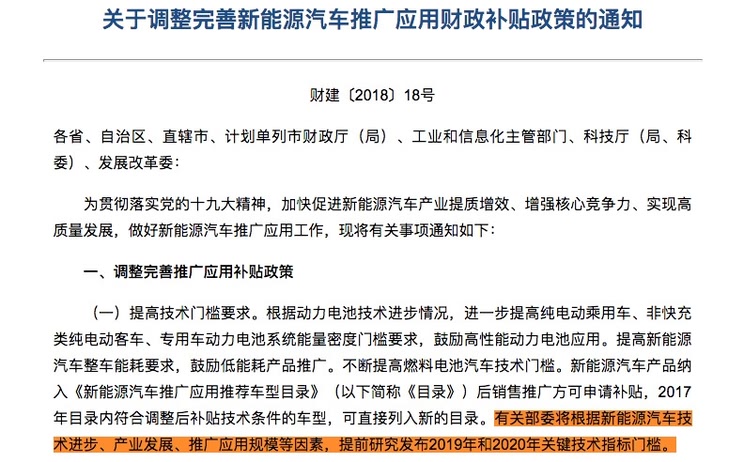

Let’s turn the clock back to February 12, 2018. On that day, the four ministries and commissions issued the subsidy policy for the promotion and application of new energy vehicles in 2018. It is clearly stated in the document that "relevant ministries and commissions will study and release the thresholds of key technical indicators in 2019 and 2020 in advance according to factors such as technological progress, industrial development and scale of popularization and application of new energy vehicles".

"Screenshot of Notice of New Energy Subsidy Policy in 2018"

This sentence brings hope to the relevant practitioners: in 2019, the business policies of various enterprises are expected to be formulated in advance, so it is not necessary to "look forward to it" as in 2018. But what I didn’t expect was that the release date of the subsidy policy for the new year came late and was not released until the end of March. However, it is understandable that, after all, it is not an easy task to squeeze tens of billions or even hundreds of billions of yuan from the central budget to subsidize the promotion and application of new energy vehicles under the background that the country is facing "increasing downward pressure on the economy".

To put it simply, the core content of the subsidy policy in 2019 can be summarized as the following three points: the amount of state subsidies is less, the technical threshold is higher, and the land subsidies are forcibly cancelled.

1. "The amount of state subsidy is less" means that compared with the subsidy standard in 2018 and previous years, this year’s standard has dropped the most. For example, the subsidy for electric passenger cars decreased by 47% from the lowest to 100% from the previous year. And in the case of non-personal purchases, the national subsidy standard will be further discounted by 30%.

2. "Higher technical threshold" includes three aspects. Take passenger cars as an example. First, the minimum requirement for cruising range is increased from 150km in 2018 to 250km;. Second, the starting value of battery energy density requirement increased from 105Wh/kg last year to 125 Wh/kg; The third is to tighten the energy consumption of the whole vehicle, and it needs to be more than 10% higher than the threshold set by the 2018 policy before it can be subsidized.

3. "Compulsory cancellation of land compensation" means that after June 26, local governments are not allowed to give users subsidies for the purchase of new energy vehicles (except buses and fuel cell vehicles), otherwise the central government will make corresponding deductions from relevant financial subsidies.

Car home has a special article on the analysis of the policy provisions in 2019, so I won’t go into details here. For interested readers, please click "Quick Review: Seven Major Changes to Interpret the New Direction of Subsidy Policy in 2019".

Second, expectations are managed in place, and the focus of enterprises is no longer more money than less money.

Although the subsidy in 2019 was much less than last year, a common feeling of Khufu when communicating with his peers was: "It was finally introduced." The reason for this attitude is that after months of waiting, people are more concerned about when the policy will be introduced than whether the subsidy amount is high or low. To use the popular expression some time ago, it is that the four ministries and commissions, including the Ministry of Finance, have put the "expected value management" of the automobile industry in place this time.

As mentioned above, the policy of 2018 stated that the policy of 2019 would be introduced in that year, but until December of that year, the leaders of the Ministry of Finance were still leading a team to the automobile enterprises to investigate how to formulate the subsidy policy. At that time, the industry practitioners had roughly predicted that the business policy of the new energy vehicles of this enterprise would cross the river by feeling the stones again in 2019.

When selling new energy vehicles at the terminal, it is a great trouble to be unable to predict the government subsidy policy. Because it is impossible to determine the subsidy policy, how much subsidy should be paid in advance in sales invoicing has become a problem that drives people in sales and finance departments crazy. From the perspective of risk control, it should be opened less, but users will not recognize this practice; If you invoice with reference to the national subsidy standard in 2018, you will face tens of thousands of yuan in profit losses. For example, a pure electric passenger car with a cruising range of 200km can get a state subsidy of 24,000 yuan last year. However, according to the regulations of the new subsidy policy in 2019, if it is licensed within three months from March 26, it can only get a state subsidy of 2,400 yuan. There is a price difference of more than 20 thousand every day.

On the other hand, considering that a new model should be tested at least nine months in advance before the announcement, it is difficult for automakers to determine the development and launch plan of new products this year due to the delay in the release of subsidy policy in 2019. After all, if a new car is launched, it will be excluded from the scope of national compensation as soon as it comes into the market, and the loss may only be borne by a local automobile manufacturer like FAW-Volkswagen. The battery energy density of the new electric vehicle released by the company on March 25th is 121 Wh/kg, which is "perfectly" excluded by this year’s new policy.

"The battery energy densities of the newly released Bora Pure Electric, Golf Pure Electric and LaVida Electric versions are below the subsidy standard"

Therefore, for industry practitioners, it is actually more important to avoid this uncertainty: only when the policy is determined can the enterprise operation strategy and strategy be determined accordingly. From January to the first month, the subsidy policy was delayed in 2019, which not only made everyone feel uncomfortable, but also objectively reduced the expectations of the industry, making everyone’s focus change from "how much subsidy this year" to "when will the policy be introduced?"

Third, a sharp slope retreat is a powerful medicine, but the effect may not be bad.

What does such a large subsidy retreat mean for the whole industry? In my opinion, it is more like a dose of croton. This is an analogy that is not necessarily appropriate but vivid.

With the downward adjustment of subsidies, the profits of all competing automobile manufacturers will inevitably be affected, but its effect on each company is not the same-strong, this laxative can help him defeat the fire, clear his intestines, and then go into battle lightly; However, those with poor physical fitness, ranging from weak legs, can’t keep up with the competitive team, and even plummet, directly withdraw from the competition.

The reason for this analogy is that, in my opinion, China’s local new energy automobile industry has gone through a stage of barbaric growth, and it must be adjusted on the supply side in order to compete with multinational new energy vehicles that are about to fully enter the China market.

First of all, the amount of state subsidies is expected to exceed 100 billion yuan, and there are areas that become financial burdens.

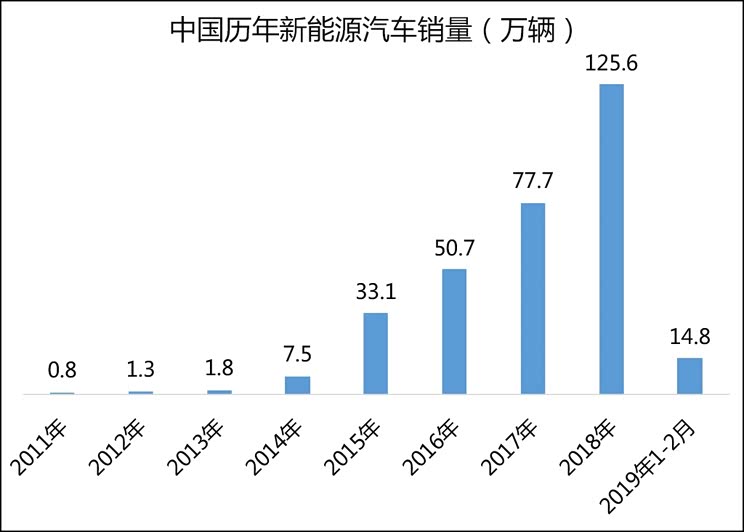

After 10 years of development, the sales volume of new energy vehicles in China reached 1.256 million last year, accounting for 3.8% of the total market. In this case, the purchase subsidy will be a heavy burden on the central finance. In 2017, the subsidy for vehicles is currently only 9.084 billion, and will be publicized in batches in the future. In 2016, the number of approved subsidies reached 346,400, totaling about 50.321 billion yuan. Previous information showed that from 2009 to the end of 2015, the central government arranged a total of 33.435 billion yuan of subsidy funds, and after six public announcements, the vehicle subsidy in 2015 increased by 3 billion yuan. So far, about 95.84 billion central subsidies for new energy vehicles have been cleared or distributed.

Therefore, it is imperative to reduce the total amount of state subsidies. In addition, in the practice of popularization and application in recent years, there are more and more local governments whose financial resources are difficult to support the purchase subsidies. They either do not introduce subsidy policies or set explicit or implicit terms to implement total control.

Secondly, China’s new energy automobile industry chain has basically taken shape, and what we need to do at this stage is to get rid of the weeds and save the cyanine.

As a strategic emerging industry selected by our government, new energy vehicles have become a key investment field. Statistics from China Automotive Technology Research Center show that in 2017, the investment in the whole industrial chain of the automobile industry reached 1.31 trillion yuan, and the total investment in manufacturing industry in that year was 6.76% of the national 19.36 trillion yuan. Among them, the total investment of investors from all walks of life in the industrial chain of new energy vehicles reached more than 740 billion yuan, which historically exceeded the total investment in the industrial chain of traditional fuel vehicles (about 570 billion yuan). This investment boom continues. According to the statistics of the Ministry of Industry and Information Technology, by the end of 2018, the accumulated investment in the entire industrial chain of new energy vehicles exceeded 2 trillion yuan. Massive funds, reflected in the vehicle production capacity, are up to 9 million new production capacity. As far as the demand at this stage is concerned, this is indeed too much, and it is only a matter of time before the price war breaks out. Reducing subsidies will accelerate this process and let those enterprises with insufficient competitiveness withdraw from the market as soon as possible. Because there are more important things waiting for us in 2020 for the whole industry.

"Source: Blue Book of New Energy Vehicles (2017)"

Third, the window of industry development is about to close, and there may be opportunities, but they are reserved for prepared players.

In the past six months, two events —— the start-up of SAIC Volkswagen Anting New Energy Automobile Factory (October 2018) and Tesla Lingang Factory (January 2019) —— have profoundly affected the historical process of the development of China’s new energy automobile industry. This can be regarded as a landmark event for multinational companies to formally enter the new energy vehicle market in China. These two companies, one of which is the leader in the mass-produced fuel automobile market, and the other is lonely in the pure electric luxury car market, have announced to the local automobile enterprises in China by investing huge sums of money to build factories: "We are serious about promoting new energy vehicles in China! "(Feng Sihan, CEO of Volkswagen passenger car brand China)

Whether we are willing to admit it or not, the day when local new energy automobile companies begin to confront multinational companies is not in 2020 or in 2021; The specific year depends on the construction speed of their new energy automobile factories in China. In this case,For local new energy automobile enterprises, if they want to compete with multinational companies, they must gain a foothold this year and next, or build a moat (to make the brand good enough) or achieve scale effect (to make the cost low enough). No matter what kind of development path, it is obviously difficult for those automakers who still expect subsidies to make profits.

In short, the sharp decline in the national subsidy standard in 2019 is not only a rational choice made by the central government based on the current financial situation, but also a measure to force China’s new energy automobile industry to carry out supply-side reform. At the time when multinational companies are about to enter in a big way, if there are some bubbles in our new energy automobile industry, it is a useful choice to puncture it by reducing subsidies. (Text/car home industry commentator Hu Fu)

Award-winning research exclusive logo come and get it.